cheap automobile car vehicle insurance

cheap automobile car vehicle insurance

: Data reveal that when it involves teens in dangerous vehicle accidents, speeding is typically an element. cheapest. It may not constantly be willful, yet it threatens just the same. Reviewing these common errors with your teen can aid them be a much safer vehicle driver. The automobile you choose for your teenager driver additionally affects your insurance policy rates.

Ways to Save Cash on Teen Automobile Insurance policy While car insurance coverage for teenagers can be expensive, there are a few ways to save - cheapest car insurance. Many insurance policy firms detail pointers, in addition to deals, that might be valuable when your teenager has to think about cars and truck insurance policy. Going on a Moms and dad's Policy As opposed to getting their very own plan, it's typically best for a teen to be added to a moms and dad's plan.

Sharing an Automobile Having fewer automobiles under one plan than chauffeurs is a substantial cash saver. Lots of automobile insurance policy service providers will certainly allow the teenager to be included as a secondary chauffeur - auto insurance. As an additional vehicle driver, he or she is taken into consideration to not have main access to a lorry, as well as this can aid you pay a reduced price than the main motorist.

Due to that, many insurance policy providers award teenagers who are excellent behind the wheel with a great student price cut (car insured). Discounts can be based on merit, the outcomes of a vehicle driver education program, or if they take a trip more than a particular distance to and from school (insurance). State, Farm, as an example, enables policyholders to save approximately 25% if the teen within the home obtains excellent qualities, as well as the savings can last till they are 25 years of ages.

In Michigan, including a teen driver to your auto no-fault plan may not cost you as high as it would certainly in other states A number of expenses are connected with having an adolescent chauffeur in your home (insurance). Once they have their license, they require an automobile to drive (be it a moms and dad's automobile or one purchased for them), they need cash for gas, the cars and truck will require to be preserved regularly, and, of course, they have to be guaranteed (affordable car insurance).

You may be surprised to discover that costs prices don't boost as much when teenagers are added to auto insurance coverage plans in Michigan, compared to some other states. As well as, ultimately, Michigan's automobile no-fault PIP advantages are vital in the Click for more info unfortunate occasion of a significant Michigan cars and truck crash.

Adding A Teen To Your Auto Insurance Policy - Incharge Debt ... - An Overview

Across the country, rates raised by 80 percent as well as in some states, such as New Hampshire, insurance costs boosted by as high as 115 percent! The price the premium may raise likewise depends on the age and sex of the chauffeur; usually, it costs even more to insure younger, male drivers rather than older, female chauffeurs (109% boost for a 16-year-old man motorist vs.

Make certain to contact your insurance agent directly to make the most of any price cuts that might use to your scenario (auto).

cheaper auto insurance insurance affordable car insurance car

cheaper auto insurance insurance affordable car insurance car

affordable cars money trucks

affordable cars money trucks

Say hey there to Jerry, your brand-new insurance policy representative (laws). We'll contact your insurer, assess your present plan, then locate the insurance coverage that fits your needs and also conserves you money. vehicle.

For teenagers, getting that initial automobile is a turning point - it works as a sign of maturation and also independence. Nonetheless, most teenagers aren't in the economic position to pay their very own auto insurance (cheaper). Yet with young adults aged 16-19 being the most likely to harm their automobiles, going uninsured isn't an option.

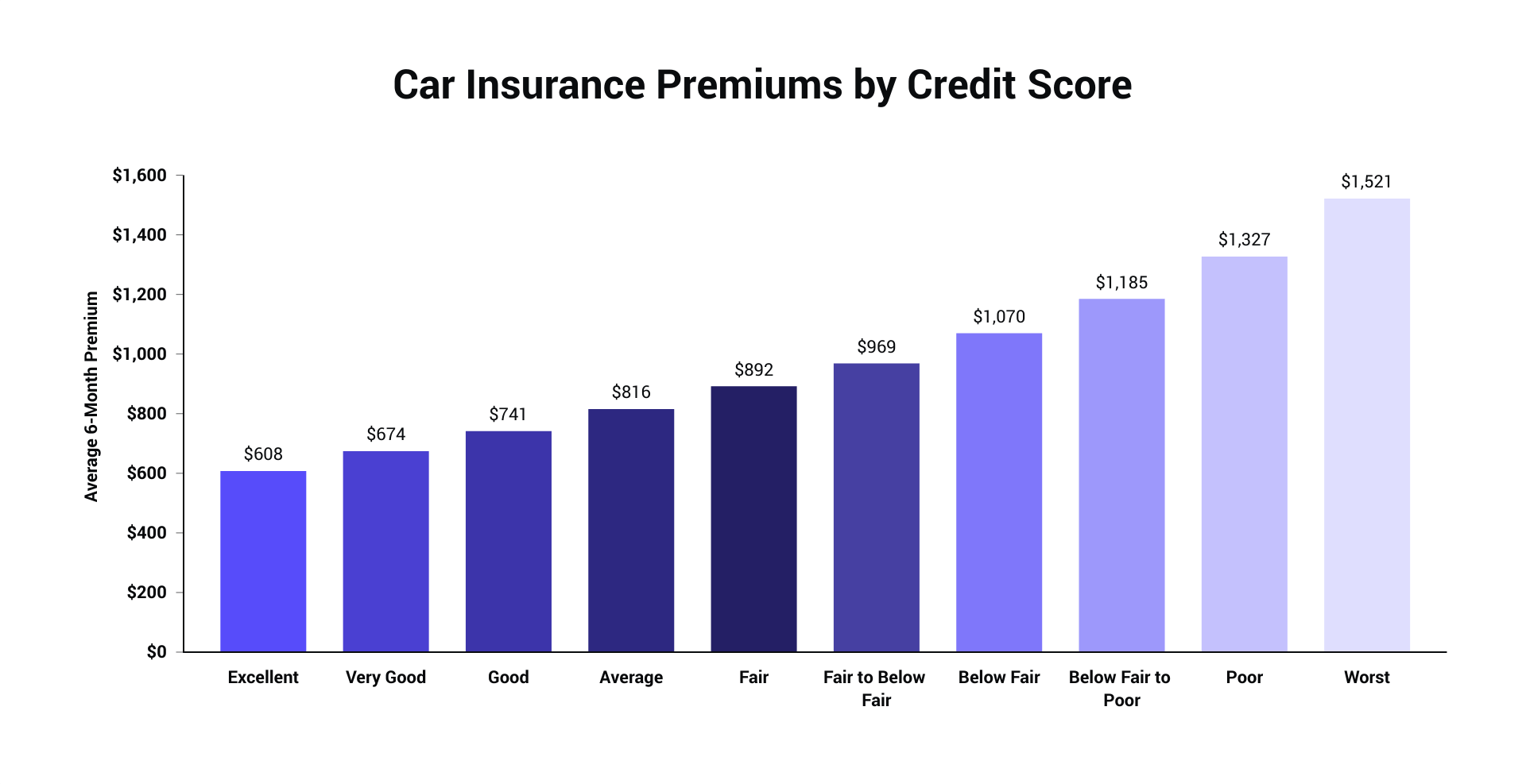

It is necessary to be aware of these 4 points before you do so. 1. credit score. Your Rates Will Certainly Enhance, Adding a teen to your policy will unavoidably boost your prices. No matter how great of a vehicle driver they are, teenagers are one of the most unskilled chauffeurs and also, consequently, the riskiest to guarantee.

2 Nonetheless, it's typically still cheaper to add a teenager to your policy rather than putting them by themselves - cheaper. You might wish to explore various other automobile insurer as well as compare what your prices will certainly be once your teen is included in your insurance policy. Keep in mind that they will likely be on your insurance coverage for many years - prices.

What Does How Much Does It Cost To Add A Teen To Your Car Insurance ... Do?

2. The Car They Drive Matters, While it may make your teenager satisfied to be handed the secrets to their glossy new dream cars and truck, that's most likely not the most effective choice when it concerns decreasing auto insurance coverage prices. Your car insurance rates go down about 3. 4 percent for every year your vehicle ages.

Know Your Insurance Plan & State Policy, It's challenging to make generalizations regarding vehicle insurance coverage because a lot depends upon the actual insurance firm itself (car insurance). Insurance provider extensively vary in rates as well as plans. Your insurance provider may have a plan about brand-new teen motorists you're not even aware of. Specific companies don't charge to cover your teenager while they have their driving license.

States have various plans when it comes to age and insurance coverage needs. Specific states call for that teens be covered by insurance to get their student's authorization, while others only need that licensed vehicle drivers be covered. In either case, it's smart to inform your insurance firm when your teen obtains their student's license and also smarter to get them guaranteed asap.

vans dui cheapest auto insurance cheap

vans dui cheapest auto insurance cheap

Explore Discount Options, Once more, this differs from company to firm, but certain insurance providers supply price cuts for young chauffeurs. Examine if your insurance coverage firm offers any one of these to obtain some relief on your teenager's automobile insurance coverage: This discount rewards trainee chauffeurs for accomplishing high qualities. The threshold depends on the insurance coverage business (cheaper car insurance).

Allow your insurer recognize when your teen leaves for college (cars). If they're not taking a car with them and participate in an university over 100 miles away, you could obtain some insurance policy relief. Among all the economic considerations to make before including your teenager to your vehicle insurance policy, there's a much more individual consideration, also: holding your teenager liable - insurers.

The point of views shared as well as worldly supplied are for basic information, and also must not be taken into consideration a solicitation for the acquisition or sale of any kind of safety.